A diversified portfolio is a cornerstone of successful investing, helping to mitigate risk by spreading investments across various asset classes. When it comes to stock market exposure, S&P 500 sector ETFs offer a strategic way to reach diversification within the realm of large-cap US equities. These exchange-traded funds (ETFs) track specific sectors of the S&P 500 index, allowing investors to focus on their investments in areas such as technology, healthcare, energy, or financials.

Think about investing in a basket of sector ETFs rather than distinct stocks. This approach provides instant diversification within each sector while offering exposure to the broader market through the S&P 500. Each ETF displays a unique set of companies, allowing investors to tailor their portfolios to their financial objectives.

- Remember that sector performance can vary greatly over time. It's essential to conduct thorough research and consider your investment horizon before making any decisions.

- Regularly align your portfolio to maintain your desired asset allocation as market conditions change.

- Seek guidance from a financial advisor to determine the most suitable sector ETF strategy for your individual needs and circumstances.

Analyzing Sector ETF Performance for Outperform the Market

Outperforming the market consistently is a coveted goal for investors. One popular strategy involves identifying high-performing sectors and allocating capital accordingly. Sector exchange-traded funds (ETFs) provide a convenient way to gain exposure to specific industry groups, facilitating investors to spread their portfolios to targeted investments.

By scrutinizing the recent performance of various sector ETFs, we can uncover potential opportunities for traders seeking to outperform the broader market. Factors such as economic trends, industry growth forecasts, and regulatory changes can all impact ETF performance.

- Additionally, understanding the challenges associated with different sectors is crucial for making informed investment decisions.

Top S&P 500 Sector ETFs for Your Portfolio in 2023

Navigating the shifting landscape of the S&P 500 can be a challenge. Portfolio Managers seeking targeted exposure to specific sectors often turn to Exchange-Traded Funds (ETFs) for optimized diversification. In 2023, certain S&P 500 sector ETFs stand out as promising options for investors looking to capitalize on sector-specific growth.

Amongst the diverse array of available ETFs, explore funds that track sectors like Technology, which have historically exhibited robust performance. Furthermore, portfolio construction strategies often benefit from incorporating sector-specific ETFs to reduce overall portfolio exposure.

Nevertheless, it's crucial for investors to conduct thorough research before making any investment choices. Factors such as fund performance should be carefully considered when selecting the most appropriate ETFs for your portfolio needs.

Delving into the Stock Market with Sector ETFs

For investors seeking a strategic approach to market exposure, sector ETFs offer a viable choice. These exchange-traded funds track the performance of specific industry sectors, permitting investors to allocate their portfolios based on industry trends and individual investment targets. By choosing ETFs that match with your capital strategy, investors can optimize their portfolio returns and mitigate overall vulnerability.

Grasping the dynamics of each sector is crucial for profitable ETF investing. Factors such as regulation, innovation, and purchasing habits can significantly shape a sector's performance.

- Investigating the underlying holdings of each ETF is crucial to ensure consistency with your investment strategy.

- Diversification across multiple sectors can help dampen overall portfolio risk.

- Observing market trends and adjusting your ETF holdings as needed is recommended.

Discovering Opportunities: Investing in S&P 500 Sector ETFs

For investors seeking to maximize their portfolio returns, sector-specific ETFs tracking the S&P 500 offer a strategic avenue for growth. These exchange-traded funds provide niche exposure to individual sectors of the U.S. economy, permitting investors to {capitalize{ on specific industry trends and potential. By spreading their investments across various sectors, investors can mitigate overall portfolio risk while seeking higher returns.

,In addition , sector ETFs offer transparency into the underlying holdings, encouraging informed decision-making. Whether you are bullish on the prospects of technology or the strength of the healthcare industry, S&P 500 sector ETFs provide a flexible tool to match your portfolio with your investment goals.

Investing in Sector-Specific ETFs offers a unique opportunity to

Sector-specific ETFs allow investors to focus on, potentially amplifying gains. These funds can offer diversification within a specific sector, reducing rank my trade overall portfolio volatility. However, investing in sector-specific ETFs also carries potential downsides. Niche fund holdings can be subject to significant price fluctuations, amplifying potential downside.

- Furthermore,

- Thorough research is crucial before allocating funds to any sector-specific ETF.

Robert Downey Jr. Then & Now!

Robert Downey Jr. Then & Now! Destiny’s Child Then & Now!

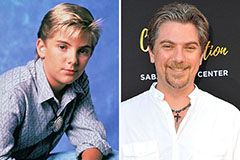

Destiny’s Child Then & Now! Jeremy Miller Then & Now!

Jeremy Miller Then & Now! Nancy McKeon Then & Now!

Nancy McKeon Then & Now! Brooke Shields Then & Now!

Brooke Shields Then & Now!